A shift is underway in India’s venture capital sector, and we don’t mean in the way these firms are investing in AI, but in the way they are using AI to streamline deal flow, decision making and their thesis.

Artificial intelligence was once seen as an add-on, but is now part of the routines of VC firms. VC money is flowing to AI startups and AI startups and models are also changing how venture investing works.

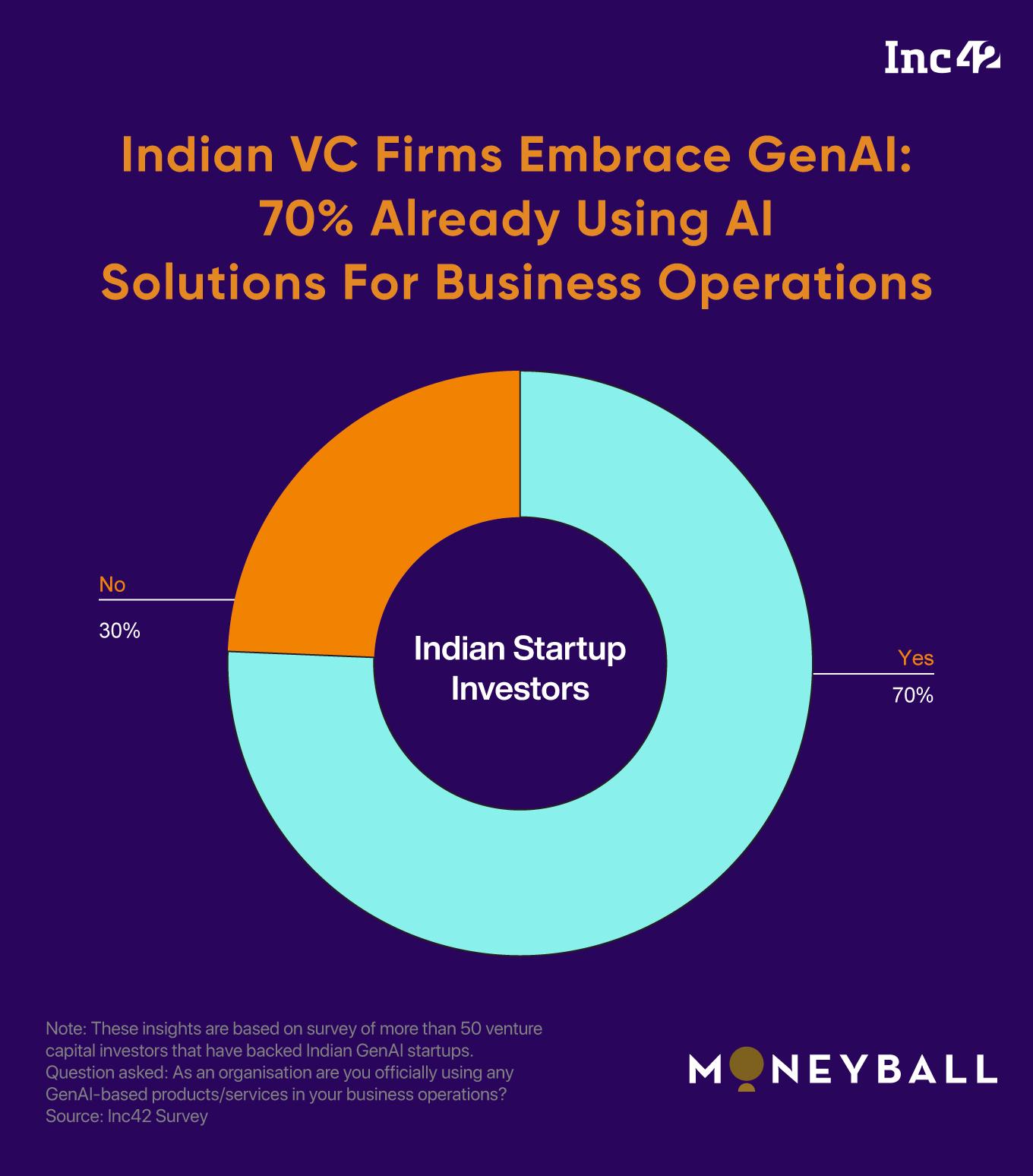

According to an Inc42 survey, are using AI in key part of their operations. This number is an early indicator. A closer look shows that AI is not a temporary experiment. It is becoming part of the core process.

The AI Journey: How Curiosity Became Capability

The AI Journey: How Curiosity Became Capability At many Indian venture capital firms, artificial intelligence did not arrive through formal plans or directives. Instead, it entered daily operations through interest and gradual use.

AI adoption across VC firms has followed a similar pattern — starting with individual use and becoming a broader capability that improved workflows and decision-making. Each firm followed its own path, but the outcome was similar: AI moved from a tool to a key part of how venture capital is done.

Silverneedle Ventures, which invests in SaaS and AI companies, brought in AI from the beginning. AI was part of their setup from the start, said founder Ajay Jain.

Then there’s Cornerstone Ventures. The VC fund’s first brush with AI was using ChatGPT for research. Managing Partner Abhishek Prasad said, though, it changed rather quickly from basic use: “In no time, almost everyone on the team was using GPT. This was as early as 2023. We were early users among the VC industry.”

What started as a test became a tool that improved workflow and decision-making.

At Good Capital, the use of AI began through a mix of interest and need. General partner Arjun Malhotra recalls that the firm was exploring investments in some AI startups and reading content like the Every blog. “Staying current with new technologies is part of our investment approach, so using AI followed naturally,” he added.

What started as a way to study the market became a part of daily operations.

The New ‘AI Stack’ For VC Firms

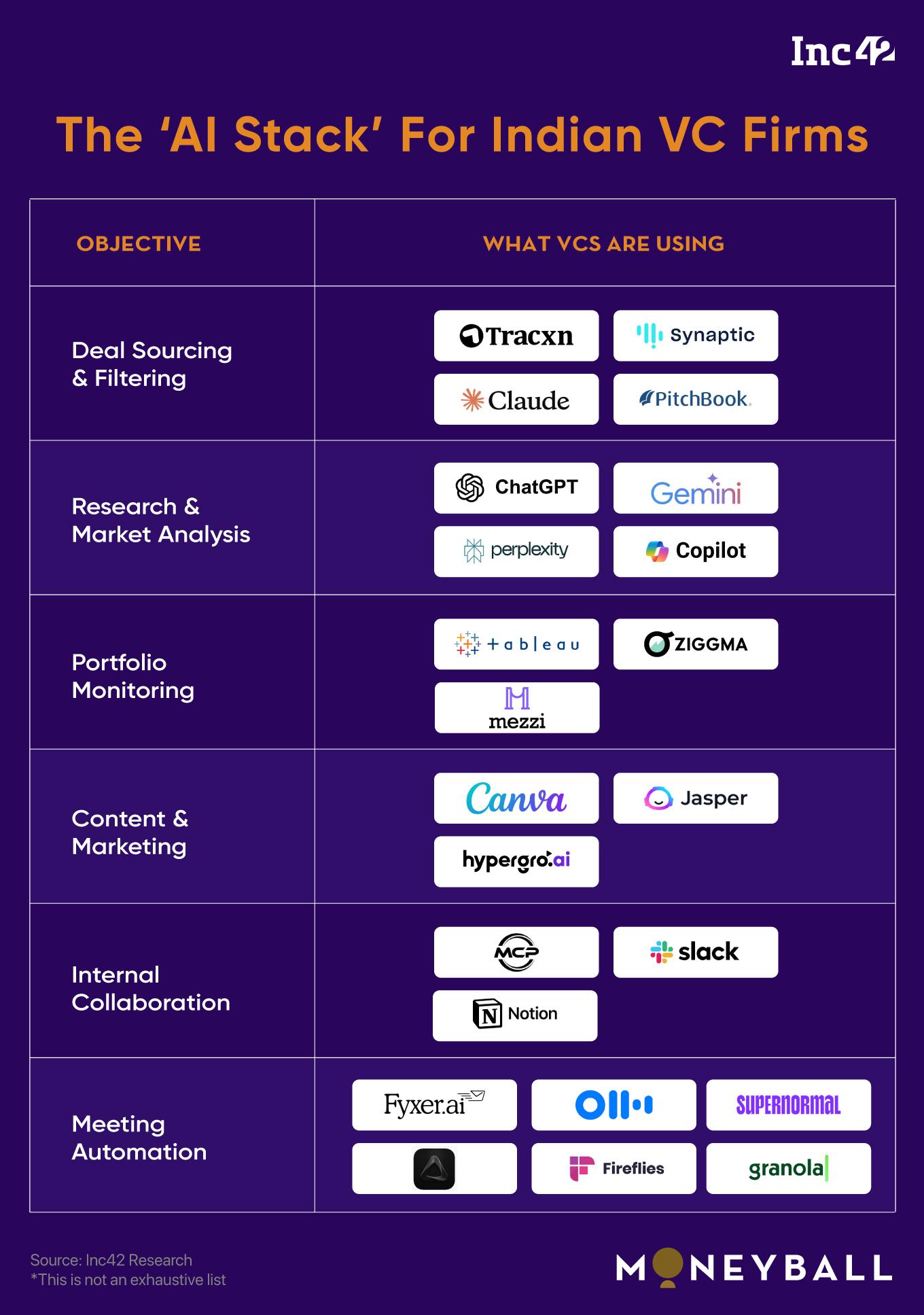

The New ‘AI Stack’ For VC Firms The venture capital tech stack in India has changed in recent years. VC firms are using a range of AI tools to support research, communication and operations. Many of these tools are standard offerings that have been adapted for internal use.

ChatGPT is widely used for research and data analysis. Jasper is used for writing, content creation and drafting communication. Canva AI is used to create visual material.

For collaboration and information sharing, tools like Slack and Notion are commonly used, with AI features that help streamline work. Some teams also use platforms like Perplexity and DeepSeek for research, Midjourney for visual content and Grok for analysis.

More specialised tools include Claude, used for managing information and OpenAI’s products for content generation. Internal systems like MCP connect multiple tools to improve consistency and performance.

The ‘AI stack’ at VC firms also includes the likes of meeting transcription and summarisation software such as Fireflies or Otter. Models like Gemini and Copilot support strategic research.

These AI tools are changing how information is used within VC firms. By automating routine tasks and enabling faster decisions, they are becoming a core part of how firms operate in a more competitive and data-driven environment.

The most noticeable outcome from the AI adoption is seen in the speed, consistency and structure in VC workflows.

For instance, at Cornerstone Ventures, ChatGPT and other primary models have helped complete tasks faster and improved input quality. This has enabled the firm to conduct deeper research and produce content more quickly, according to managing partner Abhishek Prasad.

Another example is Good Capital, where AI is being used to manage internal knowledge systems built from insights collected across portfolio companies. These systems are helping with decision-making and onboarding.

“New team members can now ramp up faster, as context is already available through AI tools. This allows more time to focus on strategic work rather than administrative steps,” Malhotra told Inc42.

Automating workflows for analysts is top of the agenda for Silverneedle Ventures and founder Jain says working with portfolio companies and adopting their AI stack also helps in documentation, process design and communication. As the firm looks to raise its next fund, Jain sees AI not only as a tool for task management but also as a way to support investment choices, and more and more limited partners want to see how AI is changing VC operations too.

Looking ahead, some firms are thinking about how to use AI beyond basic support tasks. Prasad imagines AI systems that work as matchmaking platforms for VCs, and tools that enable smoother data flow across platforms. Startup evaluation and due diligence, portfolio tracking, investor communication and deal documentation — the very decision-making is about to be influenced by AI.

The broader direction points to AI-native firms—those that build their structure around AI from the beginning. In this setup, AI is part of every decision, process and interaction. It acts not as a support tool, but as a working partner in how firms operate and invest.

Joining The Global AI WaveDespite catching up on some fronts over the past two years, Indian venture capital firms started using artificial intelligence later than some of their global counterparts.

Silverneedle Ventures’ Jain estimates that Indian firms are about two years behind global peers in their use of AI. But he believes adoption is picking up.

He expects that Indian firms will begin using AI in areas such as compliance, regional data analysis, merger and acquisition research and deal sourcing in secondary markets.

In the US, firms like Sierra Ventures . For example, the firm uses it to identify potential opportunities in sectors like healthcare. Some VC funds employ in-house AI researchers and treat machine learning as a core capability rather than a tool.

In Europe, AI is being used to monitor ESG data and geopolitical factors. Arabesque Partners, an investment firm based in the UK and Germany, an AI-powered ESG fund manager in 2021, showing that AI can run investment strategies.

In India, most VC firms continue to use general-purpose AI tools and proprietary AI systems are rare. “There is no lack of access to AI tools today. In India, adoption may have been slower, but not by much,” says Prasad of Cornerstone Ventures.

While Indian startups have been effective in building on global platforms, the country has not yet produced proprietary AI models or full-stack systems like those seen in Silicon Valley. This goes some way towards explaining why Indian VC firms themselves are lagging behind their western counterparts.

Another challenge is structural: Indian funds often avoid high-risk, research-heavy AI ventures. Ajay Jain of Silverneedle Ventures noted that short exit timelines influence this pattern.

“Exit cycles are still short. This needs to change to create a self-reinforcing growth path for AI in India,” he adds.

Despite these challenges in terms of AI innovation in India, LLMs and AI platforms are now part of core operations — changing research, data and decision workflows at VC firms. It is not replacing judgment, but it’s hard to say whether that will change soon.

As Indian VC firms build internal systems that are structured around AI from the outset, even fund managers might find themselves taking a backseat at times.

The post appeared first on .

You may also like

Telangana: MBBS student at AIIMS Bibinagar dies by suicide

Freeview viewers warned 'screen may go black' in 100 areas this week - full list

Thiruvananthapuram International Airport sees 10 pc passenger growth in 2024-25

'Pakistan Jaha Khada Hota Hai Wahi Se...': Rajnath Singh Tweaks Amitabh Bachchan's Popular Dialogue To Take 'Beggar ' Dig At Islamabad (VIDEO)

Perishers - 15th May 2025